- Boston

- Chicago

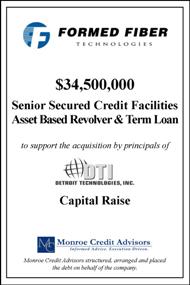

Detroit Technologies, Inc. (DTI), a leading Tier 1 automotive supplier, was pursuing the acquisition of Formed Fiber Technologies, Inc. (FFT), a long time partner of DTI. DTI was being advised by BBK, LTD., a leading business advisory and performance improvement firm. In addition to its equity contribution, DTI needed to secure debt financing to complete the acquisition under an expedited process. Given the time frame, which was driven by important new product launch dates and capital expenditure needs, as well as extensive due diligence, BBK recommended Monroe Credit Advisors be hired to focus on raising the debt.

Working closely with DTI and BBK, Monroe quickly put together a confidential information memorandum and data room describing the loan opportunity. A wide group of lenders were pre-screened and qualified to insure multiple options and contingencies. Financing options included a revolver and term loan with one lender; unitranche financing; or separate revolving and lease/term lenders. The deal was complicated by ongoing improvements to operations and cash flow, as well as financing additional capacity for new product launches. It became apparent that the best strategy was to pair up FFT’s incumbent working capital lender with a term lender that could make the loan based on the equipment collateral. With the incumbent lender and new term lender selected, the transaction successfully closed under the required time line.

Copyright © Monroe Credit Advisors LLC. All rights reserved.