- Boston

- Chicago

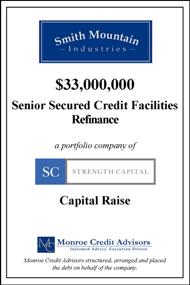

Strength Capital Partners (SCP), a leading middle market private equity sponsor, hired Monroe Credit Advisors to refinance the senior debt of its portfolio company, Smith Mountain Industries. The senior bank facility was expiring near term and the company was interested in securing a new lending partner that could help the Company achieve its business plan. Given an expedited time frame, multiple investor constituencies and need for certainty of close, SCP hired Monroe Credit Advisors to run a process and execute the refinancing.

Monroe Credit Advisors worked with SCP and the company to structure a transaction that would be attractive to the market and could help with its growth objectives. Monroe ran an expedited process where it put together the materials for distribution, identified the target list and quickly went to market to generate interest in the financing opportunity. Monroe was successful in generating a variety of financing options from ABL lenders, commercial finance companies and funds that were interested in moving forward with the transaction. Monroe helped drive the closing process, which included managing a variety of investor interests as well as two separate lenders who ultimately closed on the deal under a bifurcated structure.

Copyright © Monroe Credit Advisors LLC. All rights reserved.